Personal Finances – An Overview:

Personal Finances – An Overview:

This is never an easy topic, but one that has to be embraced at some time in our lives… sometimes twice or three times.

- Planning for our own retirement

- Engaging our ageing parents financial plan into action

- Engaging our own retirement financial plan

The article is powerful in part because it deals with an issue that — if we’re lucky — most of us will face. Despite the fact that the experience is almost universally shared, too few of us are prepared to deal with the financial challenges that tend to arise as our parents reach old age, it is now more important than ever to prepare for this stage of life.

Dealing with aging parents can clearly be trying — emotionally and financially — but you can make the process much easier if you begin to prepare before your parents face serious health problems. To get you started, here’s a look at six basic steps you’ll need to take.

Have a financial plan of your own

The first thing an adult child needs to do is protect his own financial security, to avoid serious financial difficulties while caring for their parents. Of course children want to be there for mom and dad, but it’s important to know your own financial capacity to help. If you have your own plan in place — one that takes into account the likelihood that you’ll live longer than your parents — you’ll better know those boundaries.

Unfortunately, most seniors today haven’t purchased long-term care insurance, and by the time they know they’ll need it, such policies are prohibitively expensive. But if you have aging parents, buying long-term care insurance for yourself may provide you with the certainty needed to be able to spend income and assets on your parents’ care.

Open up the conversation… gently

Getting your parents to be forthright with you about their financial situation can be very difficult. For decades, they have been the ones caring for you, and the ones dispensing advice. Reversing those roles can be trying for both you and your parents. That’s why framing the conversation effectively is important, broaching the subject in such a way that comes across as asking for help rather than offering it. Like, ‘Hey, Dad/Mom, I’ve been thinking about my long-term financial stability and it looks like you’re doing well. How did you plan for this?’” This way you can gauge if you’re parents are struggling, and if they’re not. It can also be great way to learn some planning strategies for yourself as well.

Get help

Dealing with ageing parents can be a source of acrimony between siblings. If you’re the adult child taking the lead, it’s important to involve your siblings early in the process – both to avoid resentment, and to avoid having the burden placed entirely on your shoulders. It is also a good idea to bring professionals into the conversation – a doctor, lawyer and financial adviser that your parents already trust. This will add outside authority to your discussions and help mitigate any qualms your parents have with being told what to do by their children.

Make it legal

In case your parent’s health deteriorates quickly, you or a trusted ally will need to be given the legal authority to make financial and health decisions for them. Documents like a durable power of attorney will allow a proxy to make financial decisions for your parents in case they become incapacitated. A living trust will allow a proxy to manage your parent’s estate under similar circumstances, and a will is necessary to dictate how your parents’ estate will be disposed of after they pass.

Simplify their financial life

Many seniors are resistant to online banking, but showing your folks the ropes will allow them to set up automatic bill pay, which will help them stay up on their financial responsibilities. It will also allow you to monitor their finances and make sure everything’s okay. Many individuals have their financial assets spread among a range of financial institutions; you’ll want to consolidate those assets to some extent.

Take over gradually

As you begin to take a larger role in your parents’ medical care and finances, it’s important to make the transition slowly if possible. Give them autonomy where they can handle it, as this will reduce tension between you and your parents. For health reasons, it’s also important for your parents to maintain a sense of autonomy and self-reliance.

As you move forward in the process of taking responsibility from your parents, the most important thing you can do for yourself is learn from your pa

rents’ experiences. Today, people are living a third longer than they thought they would, and that trend is likely to continue. Doing things like buying long-term care insurance and setting up your own legal directives while you’re still young will make the process that much smoother when you and your children face it.

Planning for the discussion:

If you are working with your elderly parents, choose a quiet moment to introduce a conversation about the five wishes concept. It is a good idea to document the answers. These points can formalize the five wishes as part of their legal documents, including their Power of Attorney and will documents. Five Wishes allows a person to spell out exactly how he or she wants to be treated should he or she become seriously ill. Note that specific funeral instructions, memorial services, and burial requests may be included in this document. Give your parent time to think about the following questions.

Wish 1: Whom do you wish to make health-care decisions for you, when you can’t make them for yourself?

Choose someone who knows you very well, cares about you, and who is able to make difficult decisions. Family members or your spouse may not be the best choice as they are too emotionally involved. Choose someone who is able to stand up for your wishes and lives close enough to help whenever needed. Be sure to discuss your wishes with this person; first ask if he or she is willing and able to take on this responsibility. You will need to fully discuss your wishes with this person. Ask if he or she is prepared to act on your wishes.

Wish 2: What is your wish for the type of medical treatment you want?

Traditionally this wish begins with the following statement: I believe that my life is precious and I deserve to be treated with dignity. When the time comes that I am very sick and I am not able to speak for myself, I want the following wishes and any other directions I have given to my health-care agent, to be respected and followed.

Describe your wishes for pain management, comfort issues, life support or extraordinary measures and what to do in specific situations (e.g., close to death, in a coma, or having permanent and severe brain injury with no expectation of recovery).

Wish 3: How comfortable do you wish to be?

This wish may contain specific requests; for example, music to be played, poems or favourite passages read out loud, or photos to be kept nearby. This may also include information about your grooming needs and cleanliness of bed and towel linens.

Wish 4: How do you wish people to treat you?

This wish may include requests for who you will want to be by your side in your dying days such as whom you would like to see (e.g., family, friends, clergy) and whether or not you want someone by your side to comfort you. You can also specify that you want to die in your own home (if possible) or to be in a facility with professional caregivers while family and friends visit as guests (as opposed to being caregivers).

Wish 5: What do you wish your loved ones to know?

This wish may contain statements that you want the family to know; for example, that you love them, or you may ask for forgiveness for times you have hurt family, friends, or others. It may also show forgiveness for hurts you have experienced from others. It is a wish that can evoke a need to make peace with yourself, your family, and your community; or to remind loved ones to celebrate your life with memories of joy, not sorrow. When you die, your debts must be paid first – before any money or property you leave behind is passed on to your loved ones. There may also be funeral costs, legal fees and other administrative expenses in settling your estate. There may be other estate costs, such as probate fees and taxes on investments that you may not have considered.

Common Estate Costs

Probate fees

When you die, your executor often needs proof (requested by financial institutions, government agencies and others) that they are the person authorized to represent your estate. Probate is the process that provides court certification of this fact. There can be a cost to this – and probate fees to settle your estate can be high depending on the province you live in. In Ontario, the fees (officially called an estate administration tax) equal almost 1.5% of your estate’s value.

Tax on capital gains

You’re deemed to dispose of all capital property at death. Your estate must cover the tax on any capital gains.

Tax on tax-sheltered savings plans

Registered plans such as RRSPs and RRIFs can be transferred tax-free to your spouse’s plan. If you don’t have a spouse, these savings are fully taxable at your death.

Ways to manage estate costs

Leave a valid will

Leave a valid will

If you die without a valid will, your estate gets settled according to the laws of your province, rather than according to your personal wishes. This can be a more complic

ated process, with higher legal fees and the potential for costly disputes.

Name beneficiaries for insurance and registered plans

When you buy life insurance or open an RRSP or other registered plan account, you can name a beneficiary to receive the money when you die. This means the money bypasses the estate process and is paid directly to that person. Because it does not form part of your estate, the money is not subject to probate fees and there is no delay in your beneficiaries receiving the money.

Jointly own property

Holding assets – such as a home or cottage – with another person is another strategy for reducing probate fees. Joint assets pass automatically to the surviving joint owner – and are generally not considered part of your estate and subject to probate fees. However, there can be complications to joint ownership, especially if you co-own an asset with someone other than your spouse.

For example:

- If you transfer half-ownership of an asset to an adult child – and they have a spouse who they later separate from – the spouse could have a claim on your child’s half of the asset.

- If your child has financial problems or declares bankruptcy, their ownership in the asset could be subject to claims by creditors.

- If the asset has increased in value, you may have to pay tax on any capital gains when you transfer your half ownership. This is because a transfer is considered a sale for tax purposes.

- You can no longer deal freely with the asset and must make joint decisions in managing or selling it.

Professional advice is essential: Joint ownership arrangements can be complicated. Get expert legal and tax advice before entering into one of these arrangements.

Preplan and prepay your funeral

Preplanning and prepaying your funeral doesn’t necessarily save you money, but it does remove a key expense that your family or estate must cover upon your death. When you prepay, the money goes into a trust account or insurance fund until your funeral. You gain certainty over costs because you choose the type of funeral you want in advance. And your family is saved the difficult job of making decisions during a time of grief.

Buy permanent life insurance

Life insurance proceeds can be paid to your estate to cover estate costs or left directly to a beneficiary to provide additional amounts to a particular person. The proceeds are always paid tax-free. Consider a permanent insurance policy for estate planning purposes. Permanent insurance covers you for life, no matter how long you might live. Term insurance does not.

Probate fees and life insurance

When you name a beneficiary for your insurance proceeds, the money is paid directly to your beneficiary. It does not form part of your estate and is not subject to probate fees.

You can also use insurance to cover estate costs. To do this, name your estate as the beneficiary. Your estate will pay probate fees on the insurance proceeds, but it gives your estate the cash to pay debts, taxes or other obligations. This can avoid the sale of estate assets – such as a home or cottage – that beneficiaries may want to keep in the family.

Life insurance can help cover estate costs: Taking out a life insurance policy can help cover the cost of capital gains taxes.

I know this a lot to cover in one sitting, but should really be broken down and discussed over a course of time… that allows for both parties to really have time to form questions and seek answers.

So what’s next?

Your mom and dad paid taxes all their life. Let the government take care of him/her? He/she should get rid of their assets so they’ll qualify. While some financial planners considered this to be good advice others consider it to be terrible advice.

What the financial advisor is tellingyou or your aging parent with this suggestion is that it is a good idea for your aging parent to give away his assets or otherwise impoverish himself so he can qualify for Medical Aide. Medical Aide is a state, county and federally funded health insurance program for the indigent. The benefits are quite limited

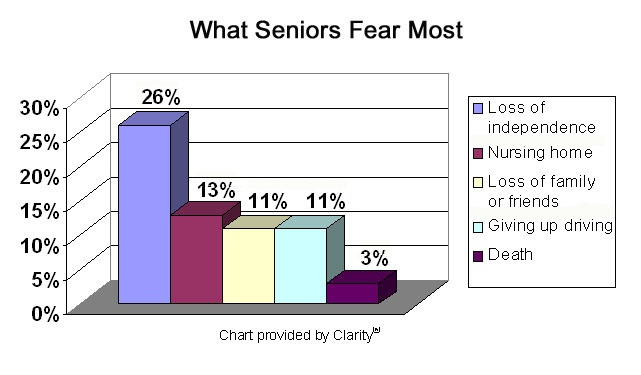

An impoverished elder may have only one option for care when care is needed for the basics, such as bathing, dressing, and walking. That option is a nursing home.

Some counties have programs, such as In Home Supportive Services, which will provide limited home care services through paid caregivers or sometimes through a relative. The care provided can enable a low income elder to remain at home rather than go into a nursing home. However, with the severe budget cuts going on in most states and provinces, these kinds of programs are either being cut back severely, or eliminated entirely.

If mom/dad needs help only with bathing, dressing, eating or meal preparation, walking, getting out of the chair or bed, or using the bathroom, Medical Aide will not cover care in a nursing home. Help with this so called “custodial care” is not a covered service under Medical Aide, or other health insurance. (Long term care insurance is the only exception).

Ask your parent what he or she wants for the long run.

“I want to stay at home as long as possible” may be in direct conflict with “I want to leave my assets to you kids and grandkids”. Some people simply do not have sufficient assets to do both, should they live long enough to need care.

Figure out the cost of caregiving at home.

There are many services that enable an older person to remain at home with additional care and services such as meals-on-wheels, adult day services, and home modifications. You will want to understand all the options in your community and calculate the costs.

Compare the cost of home care services with your parent’s income and assets. If there is no way their assets can match what they will need at home, and no other resources are available from you, or anyone else, by all means get legal advice about qualification for Medical aide. However, if they can take care of themselves with what they own, put their needs first and “your inheritance” second. Sorry, it’s their money. They deserve to stay at home with services if they want to.

Be realistic about expectations concerning inheritance.

Any competent estate attorney will advise adult children that no one is “entitled” to an inheritance. An aging parent can do whatever he or she wishes with assets. When parents lose competence and need daily supervision or have physical decline and need paid caregiving, they can burn through their assets rapidly. If your parents don’t have long term care insurance, they are likely to be paying out of pocket for the care they may need with advanced age. If that care lasts long enough, there may be nothing left when they pass.

As a person who makes a living giving advice and caring for seniors, I learn a lot from my clients. One thing I have learned based on not only my own experience but also on research is that our parents are likely to want to stay in their own homes. Most are happier if care can be brought to them, rather than expecting them to go to where the care is delivered in a facility. With that in mind, I hope you’ll carefully rethink any advice about relying on government benefits for your aging parent. Considering how to provide the best quality of life for them as they age needs to be the priority. Caring can take many forms. Helping parents plan ahead is one way to show you care.

Look down the road. Learn from what your parents did or didn’t do to plan for this phase of life. One day, it will be you and I.

Please contact us today, to discuss any challenges you may be facing and how our services can help you remain independent, protected, safe, and in you home / community.

You got questions, we have answers: (905) 785-2341 or email us at

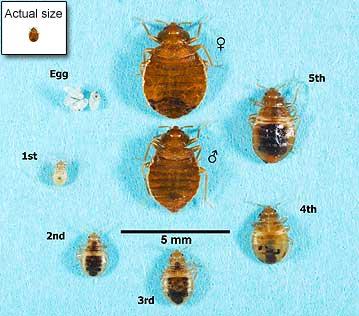

Bedbugs are small, oval, brownish insects that live on the blood of animals or humans. Adult bedbugs have flat bodies about the size of an apple seed. After feeding, however, their bodies swell and are a reddish color.

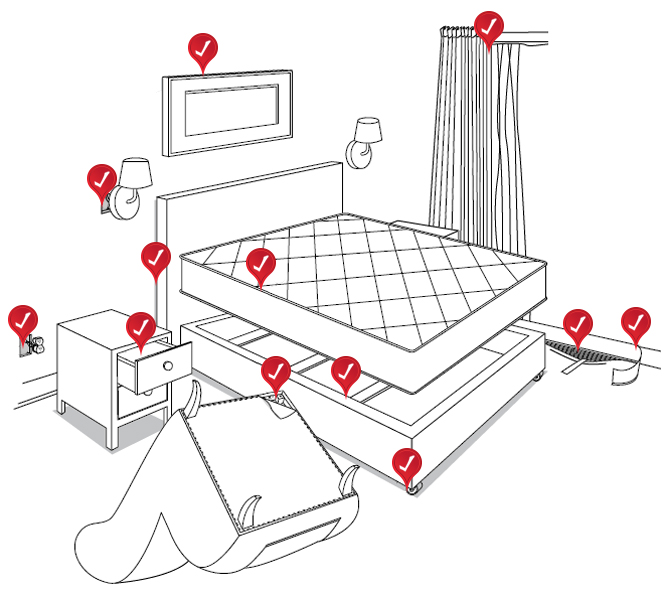

Bedbugs are small, oval, brownish insects that live on the blood of animals or humans. Adult bedbugs have flat bodies about the size of an apple seed. After feeding, however, their bodies swell and are a reddish color. Bedbugs may enter your home undetected through luggage, clothing, used beds, couches and other items.

Bedbugs may enter your home undetected through luggage, clothing, used beds, couches and other items. Bedbugs are active mainly at night and usually bite people while they are sleeping. They feed by piercing the skin and withdrawing blood through an elongated beak. The bugs feed from three to 10 minutes to become engorged and then crawl away unnoticed.

Bedbugs are active mainly at night and usually bite people while they are sleeping. They feed by piercing the skin and withdrawing blood through an elongated beak. The bugs feed from three to 10 minutes to become engorged and then crawl away unnoticed.

died. Over the next few days what will that look like for your loved ones? Your family is grief stricken and they must decide what to do with your body. They love you and want to honor your life. They go to the funeral home to make the arrangements and it is here they learn just how much their ideal tribute to you will cost.

died. Over the next few days what will that look like for your loved ones? Your family is grief stricken and they must decide what to do with your body. They love you and want to honor your life. They go to the funeral home to make the arrangements and it is here they learn just how much their ideal tribute to you will cost. ax advantages associated with an EFA (Eligible Funeral Arrangement). The Federal Government permits any amount to be paid into a prepaid funeral certificate, and the first $15,000 earns tax-exempt interest.

ax advantages associated with an EFA (Eligible Funeral Arrangement). The Federal Government permits any amount to be paid into a prepaid funeral certificate, and the first $15,000 earns tax-exempt interest.

A Summary of Canada’s Aging Population

A Summary of Canada’s Aging Population

If it sounds too good to be true… it probably is not.

If it sounds too good to be true… it probably is not.